Which of the Following Best Describes Money Laundering

Credit cards are effective instruments for laundering money because the. Money launders use a wide range of methods to make illegally sourced money appear as clean.

The online survey was emailed to the entire ACAMS database.

. The stages of money laundering include the. Money laundering is the criminal practice of filtering ill gotten gains or dirty money through a series of transactions so that the funds are cleaned to look like proceeds from legal activities Money laundering is the practice of sorting money into like sets of currency amounts. A legal transfer of funds through the usual international payments mechanisms.

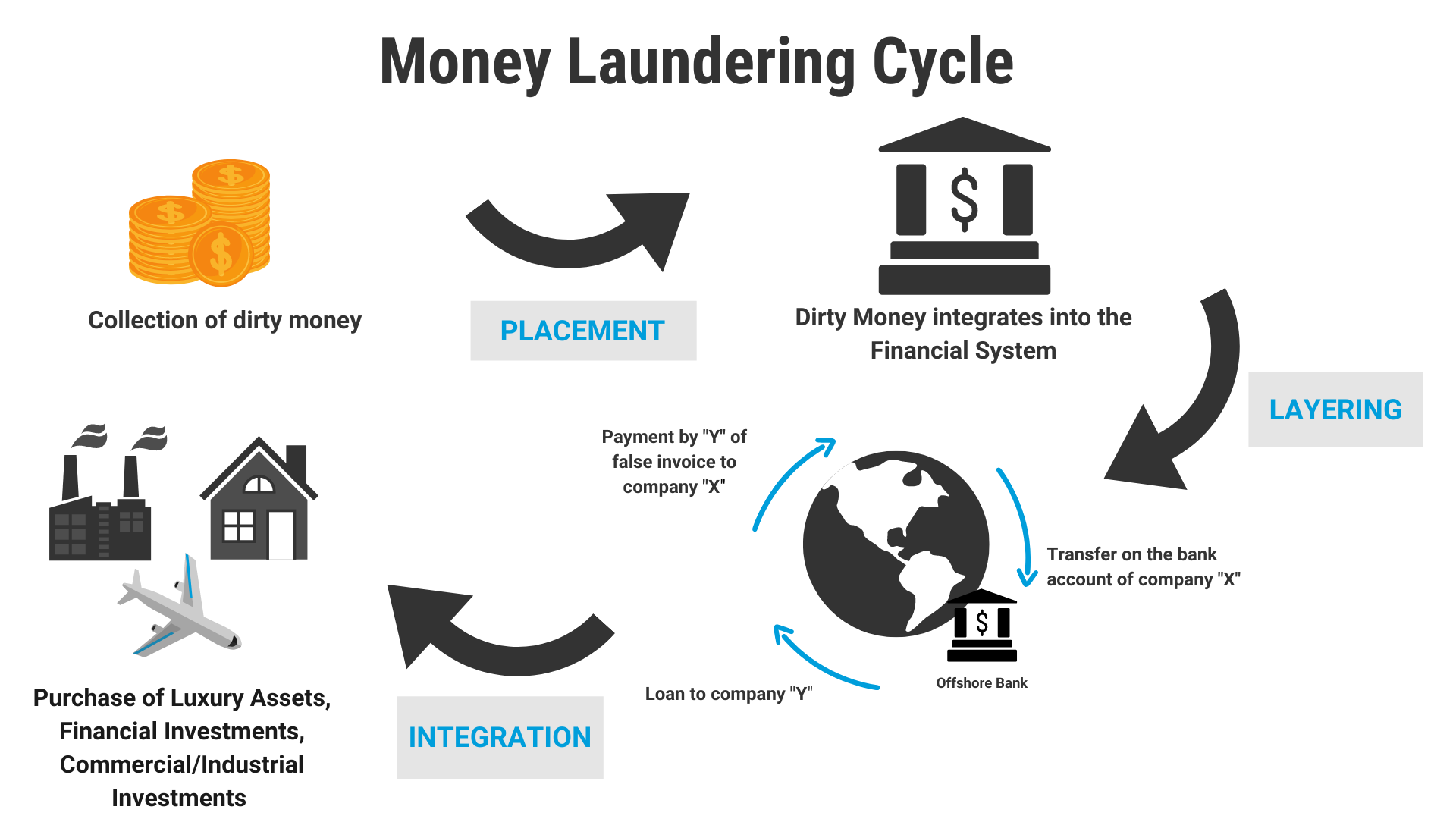

Anti-Money Laundering Specialists ACAMS Methodology. A Withdrawal B Placement с Integration D Layering Which of the following statements BEST describes the amount of money than can be physically brought into or out of the US. Introducing illegal funds into the formal financial system for example making structured cash transactions into bank accounts.

Select all that apply Transactions must include at least 10000 or more of illegally obtained money. Which of the following statements best defines money laundering. Transactions must include at least 100000 or more of illegally obtained money.

However it is important to remember that money laundering is a single process. Which of the following best describes the criminals money laundering scheme. An elaborate and convoluted scheme to hide money.

A Any amount can be transported but all amounts over 10000 must be. Money laundering is the illegal process of covering up the origins of money acquired through criminal activity. B the transfer of cash into collectibles that are then transferred across borders.

Criminal activity that involves pre meditated murder. Lawful or unlawful activity that involves willful blindness and if there is an international element to the crime can lead to a suspicious activity report. Money laundering is the process of making large amounts of money generated by a criminal activity appear to have come from a legitimate source.

B The rise of the global market increases the risk of money laundering. A ghost employee is created to defraud payroll. Carol is subject go the training and additional provisions on the USA PATRIOT ACT and AML training due to the nature of the relationship she has with her company.

A simple plan to hide money. The criminal creates a pyramid of investors in which lower rungs pay for investment returns on upper ones while the criminal siphons money. Illegally obtained money is rendered legal in a three-step process.

Combating money laundering became a compelling priority for financial institutions on. Layering the substantive stage of the process in which the property is washed and its ownership and source is disguised. Which of the following statements BEST describes the need for global accounting standards.

Traditionally money laundering has been described as a process which takes place in three distinct stages. Which of the following best describes money laundering. O C June 2 2010.

Questions and Answers. 1 O C October 26 2001. Unlawful activity whose proceeds if involved in the transaction can give rise to prosecution for the crime of money laundering.

Typically a money launder will cover up the funds origin by passing it through various banks and legitimate businesses. Moving dispersing or. C the cross - border purchase of assets that are then managed in a way that hide the movement of money.

From February 25 - March 12 2013 LexisNexis and ACAMS conducted a joint research study to examine how the Anti-Money Laundering community is managing their Customer Enhanced Due Diligence and AML Risk Assessment processes. The opening of a bank account. All of the following are phases in the money laundering process EXCEPT.

They should know about the money-laundering risks to your firm and make sure steps are taken to mitigate those risks effectively. To confuse the money trail for the funds he purchases an expensive insurance contract with the illicit funds cancels the policy shortly after and receives a refund in a foreign bank account. Which of the following is true of money laundering.

What is money laundering. The money laundering cycle describes the typical three-stage process criminals may use to conceal the source of illicit funds and make funds appear legitimate. The money laundering cycle can be broken down into three distinct stages.

Carol works in the insurance industry. Which of the following is the best definition of money laundering. Securities firms are most often used by money launderers to.

Appoint a Money Laundering Reporting Officer MLRO who is a focus for the firms AML activity. Which one of the answers best describes predicate offences. The term comes from the notion that illegally obtained money is dirty money and most be laundered.

Money from sales is stolen before it gets recorded. Criminal activity that leads to money laundering. Which best describes money laundering.

Which of the following best describes the money laundering process. Converting money illegally obtained into seemingly legitimate resources. All of the following statements about an insurance companys AML training program are correct EXCEPT the training program.

The laundering is done with the intention of making it seem that the proceeds have come from a legitimate source. Give overall responsibility for anti money-laundering systems and controls to a director or senior manager. A criminal is attempting to launder stolen funds.

A must include a segment on FATF. Placement the stage at which criminally derived funds are introduced in the financial system. View the full answer.

Money laundering involves a two. Credit cards are not likely to be used in the layering phase of money laundering because of restrictions in cash payments. Money laundering is a term used to describe a scheme in which criminals try to disguise the identity original ownership and destination of money that they have obtained through criminal conduct.

QUESTION 35 Which of the following statements is true. A The complexity of the global market increases the risk of unethical accounting behavior by allowing accountants to choose which national GAAP standards are best for their clients. Which of the following best describes the money laundering process.

Converting money illegally obtained into seemingly legit resources.

Money Laundering Overview How It Works Example

Quiz Worksheet What Is Money Laundering Study Com

11 Companies Leading The Way In Online Trading Online Trading Stock Market Investing Stock Options Trading

No comments for "Which of the Following Best Describes Money Laundering"

Post a Comment